How to Get a Suppressor Tax Stamp

If you’re new to the world of suppressors, then you’ve probably heard different bits and pieces about the buying process, which includes a tax stamp. Naturally, that probably led you to wonder how, exactly, to get a suppressor tax stamp. Well, it isn’t that difficult, but like all things involving the ATF, it can be stressful if you don’t fully understand the method behind the madness. There’s a lot of misinformation and confusion out there, too, especially when people talk about ATF Form 1 vs Form 4 suppressors, trust vs individual registration, paper vs eFile, and more.

Knowing how to get a tax stamp for a suppressor is half the battle. Getting the suppressor itself is the other half, especially when you consider how long it can take to get a suppressor tax stamp. So, let’s take a closer look!

Table of Contents

- WHAT IS A SUPPRESSOR TAX STAMP?

- DO I NEED A TAX STAMP?

- HOW DO I GET A TAX STAMP FOR A SUPPRESSOR?

- GETTING YOUR SUPPRESSOR TAX STAMP

- IS A SUPPRESSOR TAX STAMP A YEARLY FEE?

- CAN I BUY MULTIPLE SUPPRESSORS WITH ONE STAMP?

- DO I HAVE TO CARRY MY TAX STAMP WITH MY SUPPRESSOR?

- WHO DO I HAVE TO SHOW MY TAX STAMP TO?

- GET STARTED TODAY

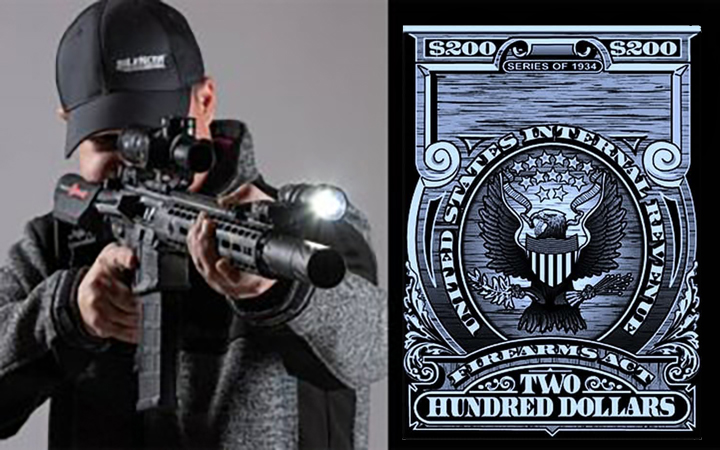

WHAT IS A SUPPRESSOR TAX STAMP?

For starters, a tax stamp isn’t just for suppressors. You need one for all National Firearms Act (NFA) items, which also includes machine guns, short barrel rifles, and short barrel shotguns. The need for the stamp dates back to 1934 with the passage of the NFA, which put the aforementioned items under strict federal regulatory control of the Bureau of Alcohol, Tobacco, Firearms, and Explosives (BATFE), or, more commonly, ATF.

DO I NEED A TAX STAMP?

The answer to whether or not you need a tax stamp for a suppressor, machine gun, short barrel rifle, or short barrel shotgun is yes. You absolutely need a tax stamp in order to own one of those items. It doesn’t matter if you’re buying one from a dealer or making one yourself, you have to get a tax stamp. (With the exception of a machine gun. You can buy one with a stamp, but you absolutely cannot make them under any circumstances, tax stamp or not.)

HOW DO I GET A TAX STAMP FOR A SUPPRESSOR?

There are two ways to get a suppressor tax stamp. The first way is to buy a ready-made suppressor on an ATF Form 4. This means you are buying a suppressor from an FFL dealer or manufacturer who is selling a suppressor, like what we do at Silencer Central.

The other way to get a suppressor tax stamp is to file an ATF Form 1, which is the application to manufacture an NFA item. If you’re handy with machine tools, you can make your own suppressor at home, although it might not be as effective as a commercial model. You can also buy “solvent trap” kits that exist in a vague legal gray area and can be readily turned into suppressors. Talk to a good firearms lawyer before you Form 1 some of these “not-a-real-silencer” kits so that you can avoid any legal issues in the future. That’s one of the main benefits of buying a manufactured suppressor on a Form 4. No one has ever had the legality of a Form 4 suppressor challenged by the ATF.

Buy A SilencerGETTING YOUR SUPPRESSOR TAX STAMP

Most people use a Form 4 when buying their suppressor. When you buy from Silencer Central, we make buying a silencer simple. We are approved by the ATF to handle the entire suppressor sales process digitally and by mail – you never have to come into one of our retail offices or visit a local gun shop. With other dealers, you’ll be filling out the paperwork on location and returning again when the ATF approves your application and background check.

The actual stamp that you receive will vary depending on whether you filed a paper application or an eFile application. If you submitted a paper application, then you will get back an actual, physical stamp that has been placed on your ATF Form 1 or Form 4. If you eFiled your application, then you will have a printed stamp that has been digitally placed on your ATF Form 1 or Form 4. Either way, the stamp is proof positive that you have an official, approved ATF Form and you can now enjoy your suppressor or other NFA item.

IS A SUPPRESSOR TAX STAMP A YEARLY FEE?

Thankfully, no, a suppressor tax stamp is not a yearly fee. It’s a “one and done” tax of $200 that is paid up front with your application. Once your application is approved and you receive your suppressor and stamp, it’s valid for as long as you own the suppressor.

CAN I BUY MULTIPLE SUPPRESSORS WITH ONE STAMP?

Unfortunately, no, you cannot buy multiple suppressors with one tax stamp. You have to pay the $200 tax for each suppressor that you want to make on a Form 1 or buy on a Form 4. However, once you’ve paid the $200 tax at the beginning of the process, then you’re paid up for as long as you own the suppressor.

DO I HAVE TO CARRY MY TAX STAMP WITH MY SUPPRESSOR?

It’s always a good idea to keep a copy of your tax stamp and other suppressor-related paperwork (like your trust documents) with you when you’re either traveling with your suppressor or shooting with it on the range. Notice that we said a copy of your stamp and paperwork. Don’t take the originals with you and risk losing them. Make copies and keep the original stamp and other paperwork locked up in a secure place.

WHO DO I HAVE TO SHOW MY TAX STAMP TO?

Generally speaking, the only people who you legally have to show your tax stamp to if asked to do so are ATF agents and law enforcement professionals. Range Safety Officers or other range staff are not included in the list of people to whom you have a legal obligation to show your tax stamp. However, as a private establishment, the range has every right to ask to see your paperwork and they are within their right to ask you to leave if you do not abide by their rules.

GET STARTED TODAY

At Silencer Central, we are passionate about compliance, knowledge, and community education in firearm sound suppression. With more than 15 years of experience in the industry, we are the nation’s largest silencer dealer. We’re also the only one licensed in all 42 suppressor-legal states that can sell, process, and ship your new suppressor directly to your front door.

Like all things in life, there’s always something more to learn. Hopefully, the information about tax stamps in this article helped answer a lot of your questions. Of course, it’s also possible that it brought some new questions to mind that you hadn’t thought of before. Or, we might have overlooked your question altogether. Whatever the case, we’re here to answer any and all of your questions and then get you started on your own journey to suppressor ownership.

START YOUR ORDER TODAY